Hi all,

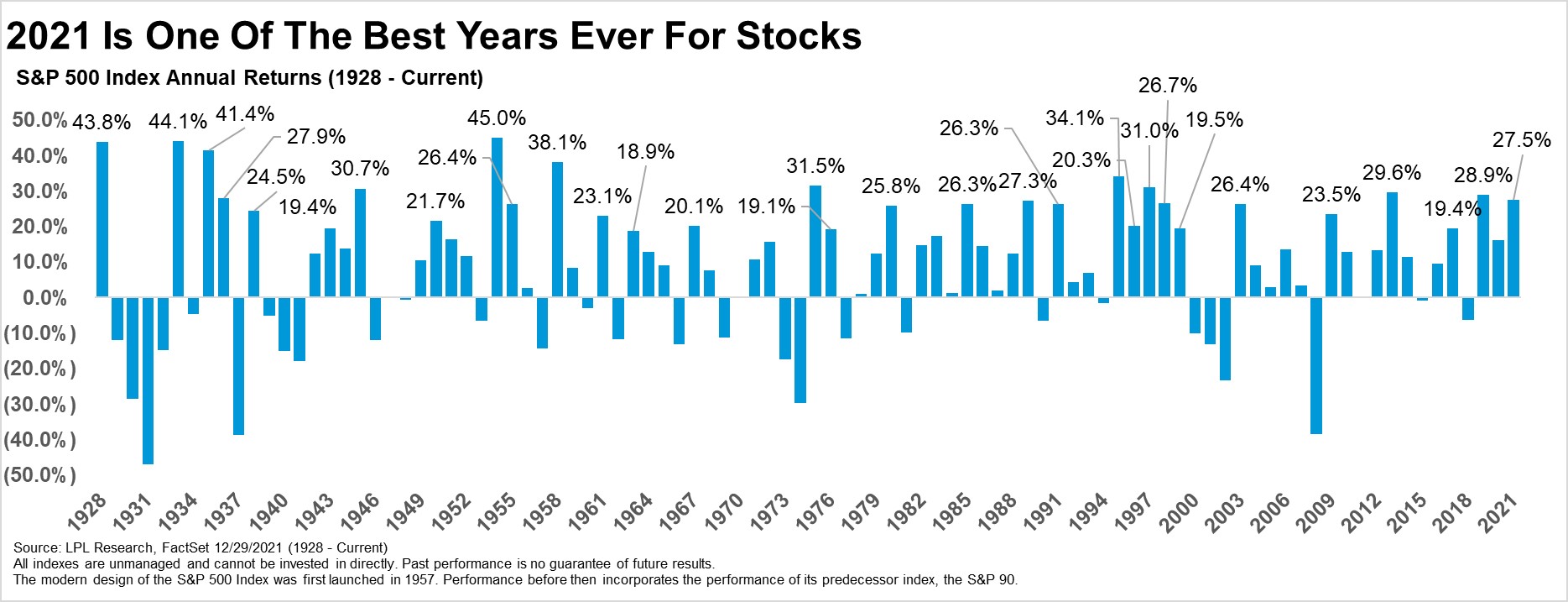

2021 was a stellar year in the financial markets with the S&P 500 up almost 30% (including dividends).

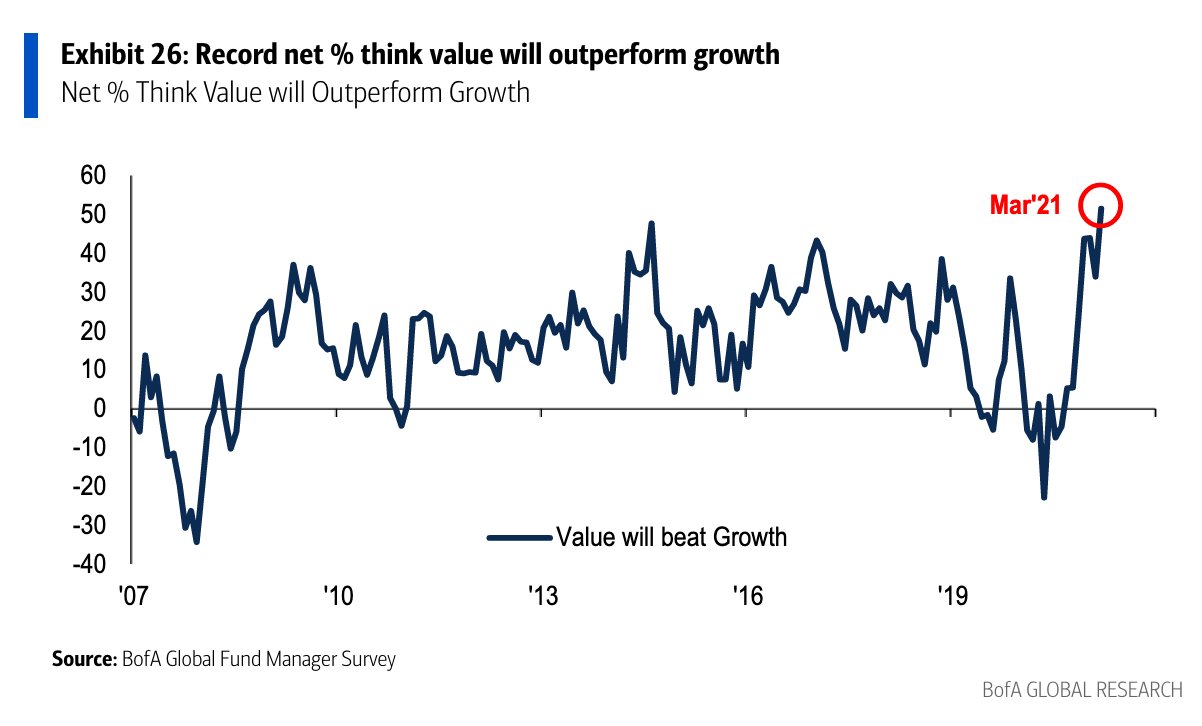

The strategy of not overthinking the pandemic-related changes proved fruitful, and while we saw some glimpses of the potential start of the “great rotation” (growth to value), the largest companies became even larger. Apple, Microsoft, and Google (with their combined value of more than $7 trillion), saw their stocks rise 30%, 50%, and 60%, respectively.

Over the past few years, our position has been some variation of “the trend is your friend”, but in 2022, we feel this is likely to change. Here are some risk factors that will determine where equity markets end 2022.

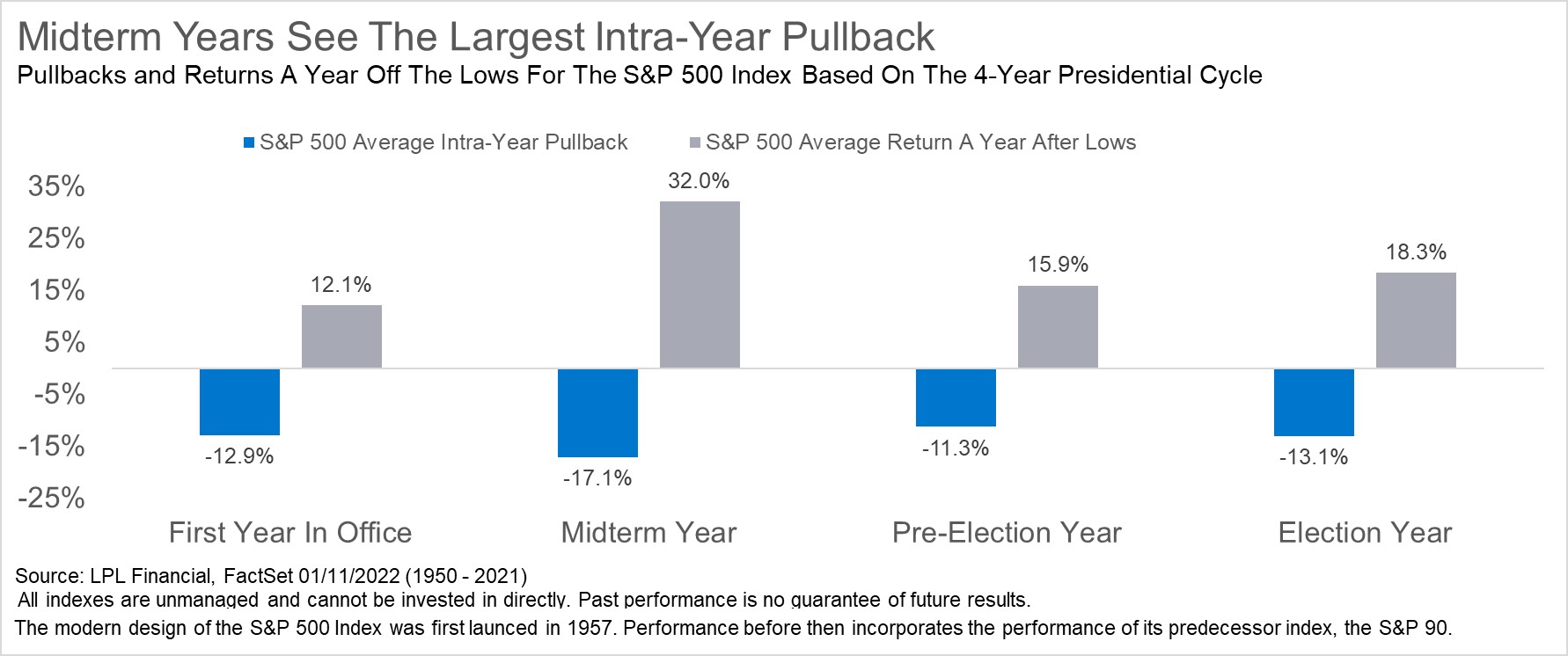

Politics and the Economy – Our first chart comes from Ryan Detrick at LPL Financial. As you can see, mid-term election years tend to see the largest volatility of any year in the election cycle. We feel this year will be no different. Expect wider ranges and deeper pullbacks.

As of right now, the way-too-early mid-term election polls are mixed, but certainly not terribly positive for the Dems. Higher odds for a divided congress and further governmental gridlock are on the rise. Divided houses of congress are generally a positive for equity markets (no news is good news).

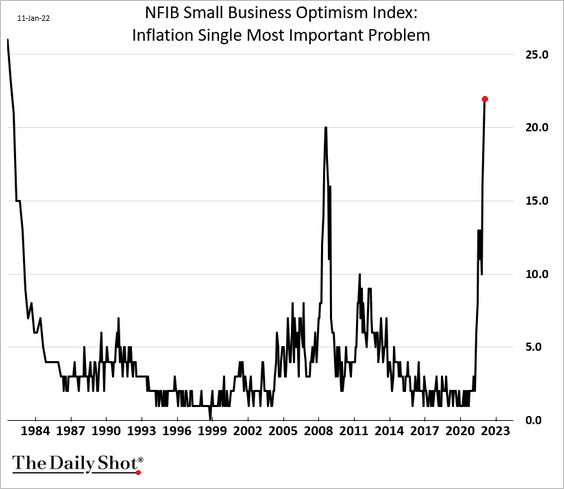

According to the WSJ, small businesses are more worried about inflation than they have been in the last 40 years.

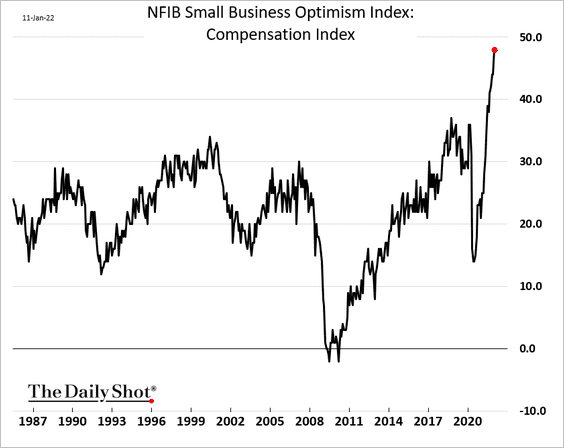

On the flip side, while price inflation is in focus, the greatest number of small businesses raising the wages for their workers is also the highest in over 40 years.

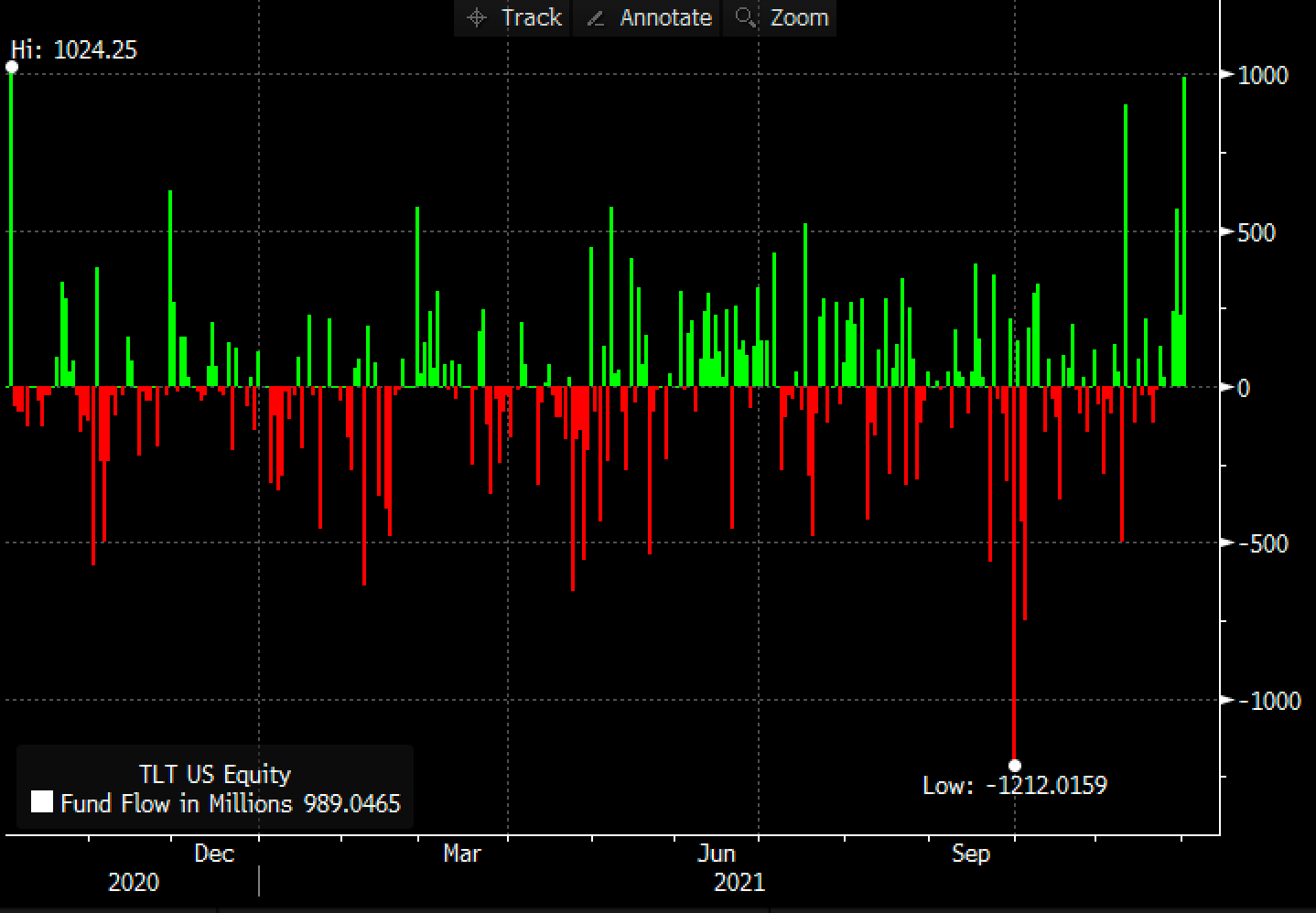

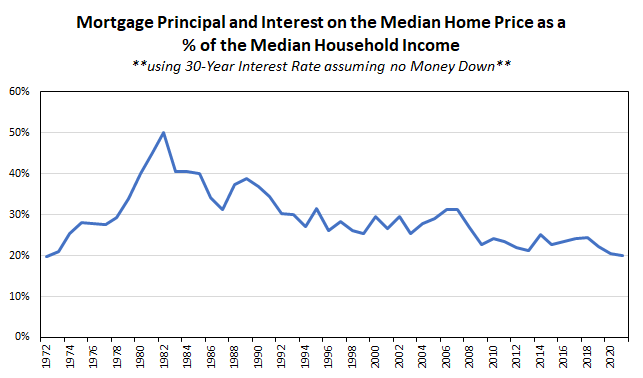

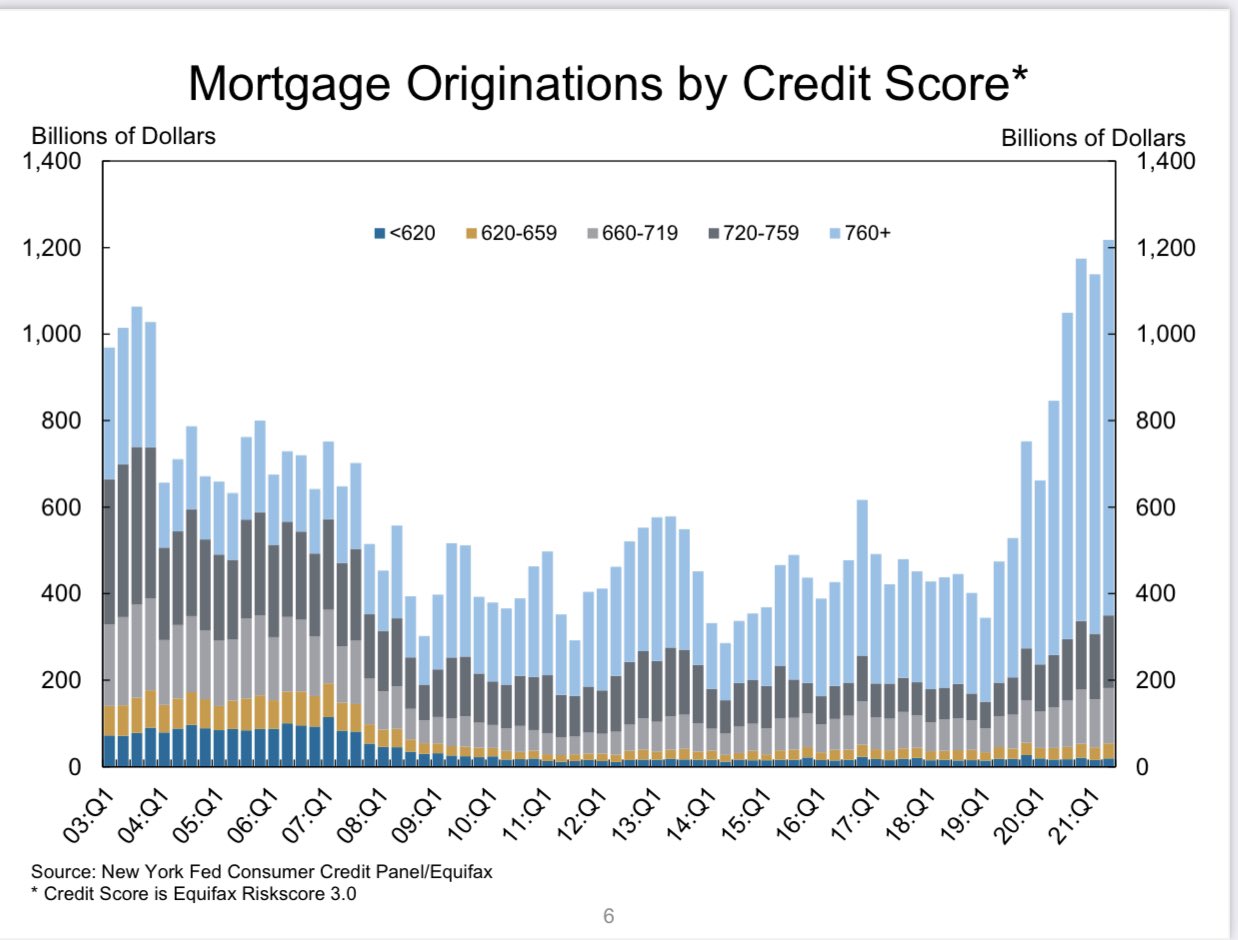

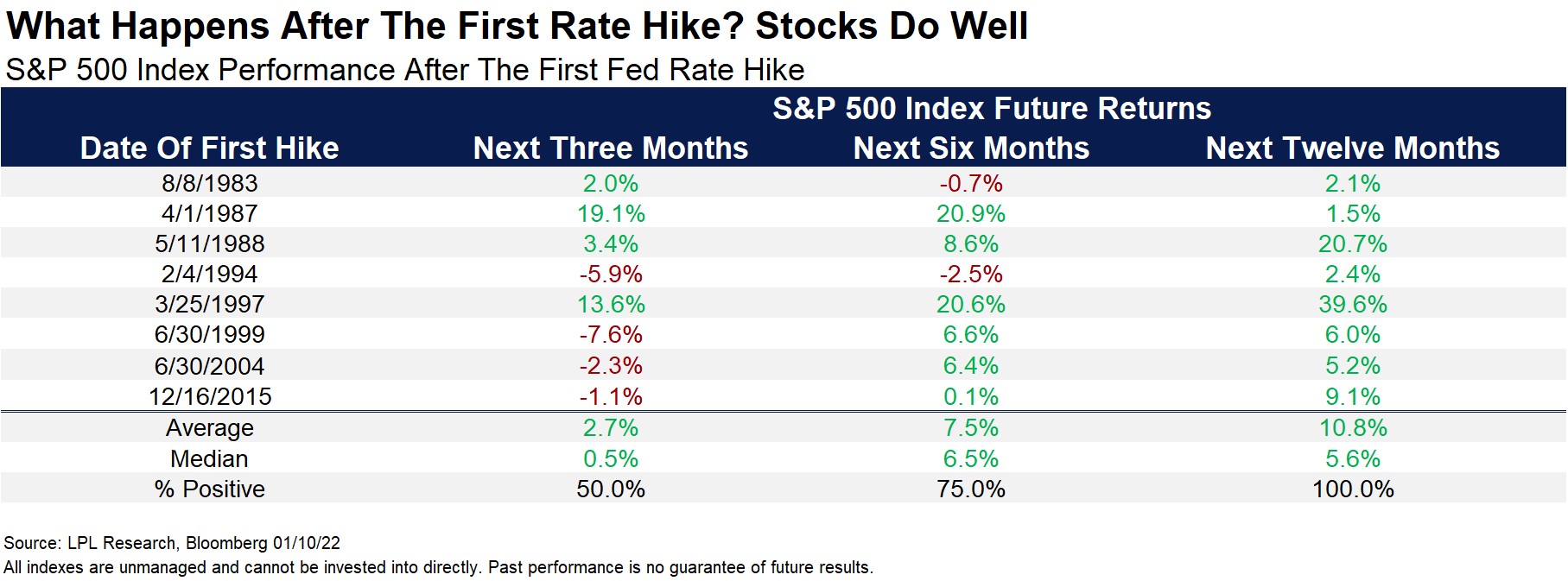

Federal Reserve – We can’t tell everyone “don’t fight the FED” for the last 13 years, and when they change course, still put out reasons why the market is bullish. In our opinion, that makes you a permabull, not an impartial advisor. That being said, our job as advisors is to find a way to make money in any market environment, and while rising interest rates will tamp down economic activity (and subsequently inflation as well), the timing of when the market hits the proverbial skids is a little different than you might think. Over the past 40 years, looking 12 months out after the first interest rate hike, the market is higher 8 out of 8 times. We believe 2022 will make it 9 out of 9.

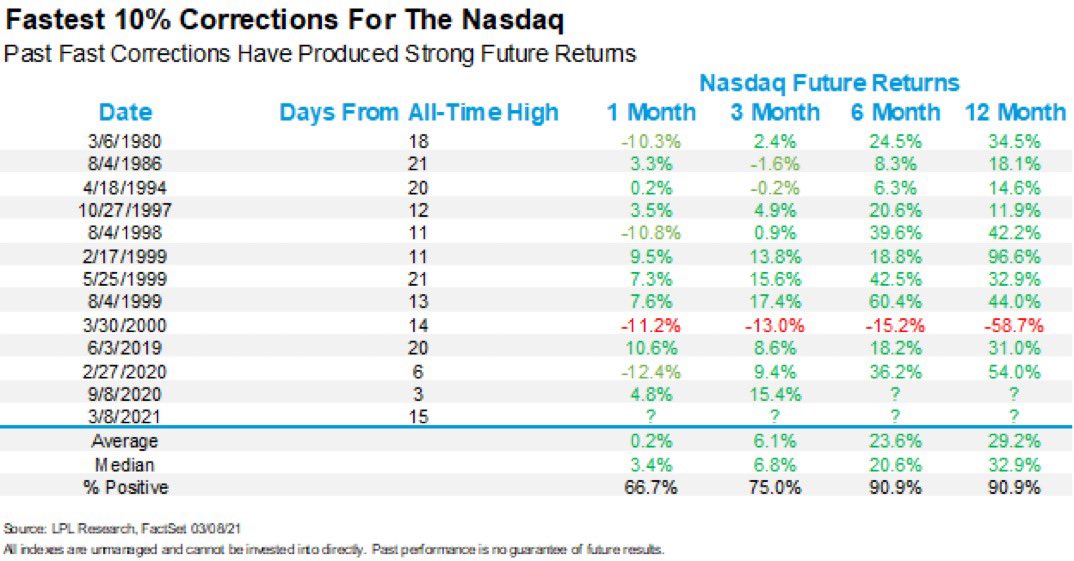

Overall we’re expecting a year of fits and starts, one that will likely annoy almost all participants. Timing luck will be an important part of overall return, so while the indexes are down 5% or 10% from their highs, we see these are buying opportunities, but with the caveat that there is a likelihood we still go lower in the short-term.

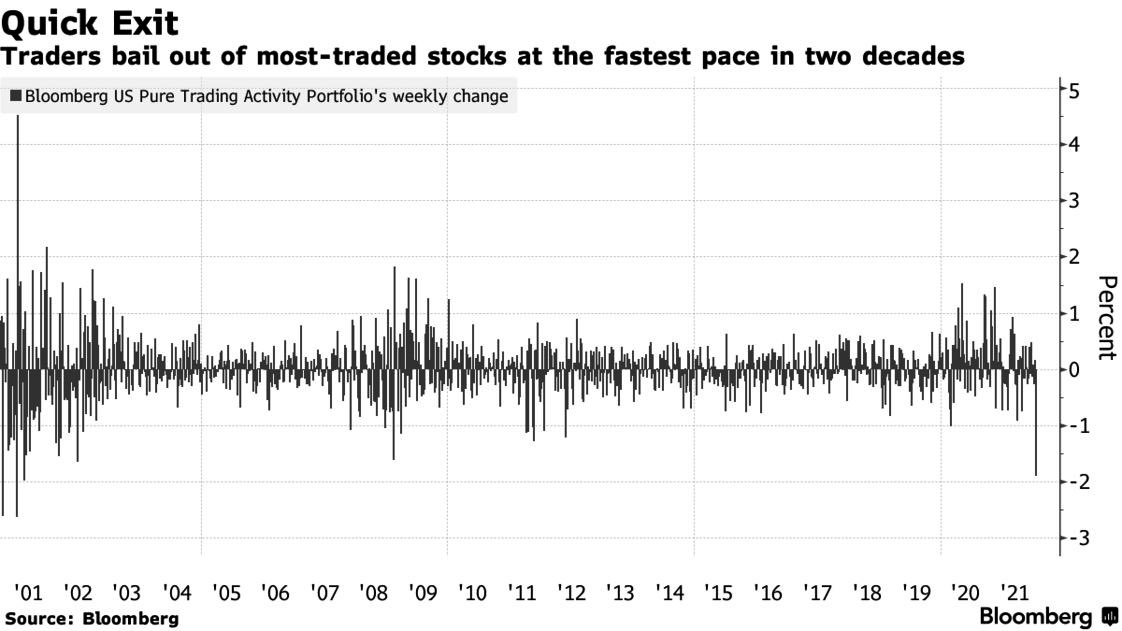

We are forecasting a single digit increase (3-7%) in the S&P 500 for 2022, as any excess gains beyond the trend of the last 30 years (around 10% per year) will likely be seen as a green light for Fed officials to continue to tighten monetary conditions. As market participants realize this, traders will start capturing small gains quickly instead of holding larger positions for longer (the optimal strategy in trending markets).

We believe money will likely start to seriously flow to those countries and sectors where monetary policy is likely to remain easy, even while the US moves to combat inflation. It’s said that when the US gets a cough, the rest of the world gets a cold. The USA is the only country on the planet that is now in a better economic place than it was pre-COVID. We think the rest of the world will need additional time and medicine (accommodative monetary and fiscal policy) and we expect money to flow to Europe, China, etc. A geographically diverse portfolio, while a drag on performance in previous years, could be the piece that outperforms in a transition 2022.

– Adam