It’s the number one question on everyone’s mind.

“Where’s the bottom?!?”

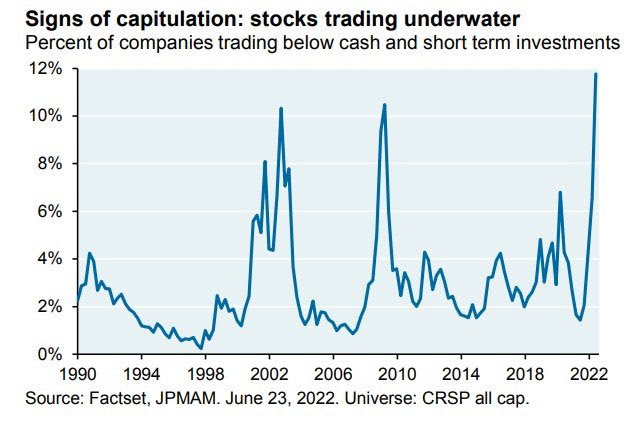

I don’t know. I also know that no one else knows. So assuming NO ONE on the planet can predict where we might go next (although I’m certain some of you are SURE the market is going lower), let’s examine for a minute, what a major market bottom looks like.

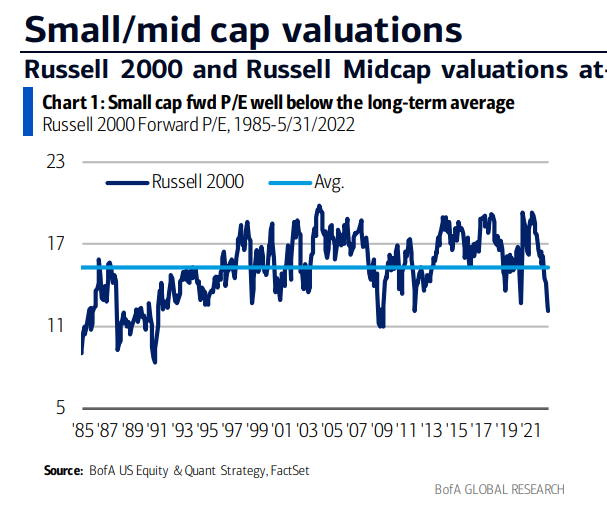

Like many, I believe the S&P 500 will be higher, 12 months from now. I believe this for many reasons. They are outlined in several previous posts about negative sentiment, oversold conditions, historical numbers looking 12 months out from a large number of stocks making their 52-week lows, etc. But rather than picking a bottom (which is pure luck, even if we were to do it), here’s the conditions that need to occur for a bottom to be cemented. This is a bit more technical than some other posts, so if you’re my wife, you can stop reading here.

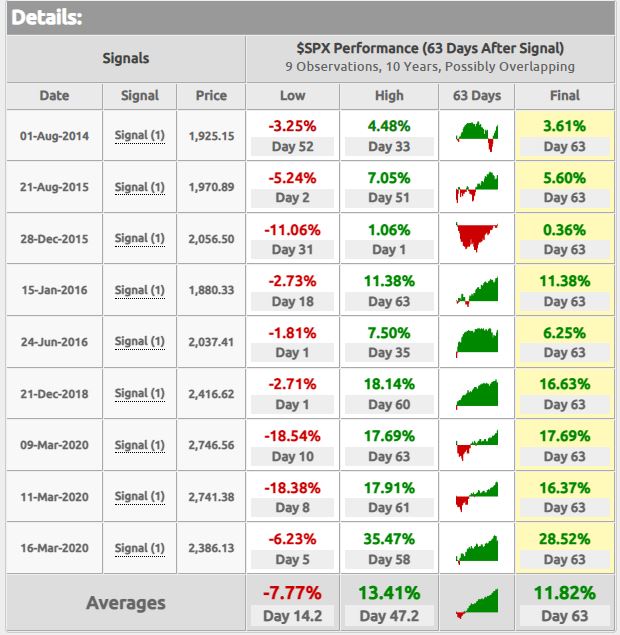

Since 1945, there have been 24 instances of a term Walter Deemer coined in the 1970s called “Breakaway Momentum” (also now known as a “breadth thrust”). This occurs when ten-day total advances on the New York Stock Exchange (NYSE) is greater than 1.97 times the ten-day total NYSE declines. It usually comes in three parts. The first is the initial strong bounce off of major lows, which usually occurs during several days (we’ve seen a few of these “one-week wonders” recently, each one a hallmark of a bear market). Secondly, during the middle part of the 10-day stretch, the market needs to HOLD its ground. The real trick to achieving breakaway momentum is not to keep going up substantially everyday, but to keep the declines limited during the inevitable ups and downs that occur in any ten-day period. Lastly, during days 7-10, the market again has a major bullish move (William O’Neil coined the term “follow through day”) to give the final signal that stocks have bottomed.

When we get into bear markets, investors lose their anchor (and their nerve). There is no way whatsoever to know how low, nor for how long, the S&P 500 will go between now and that 12-month end point. Maybe not much at all, but maybe a whole lot.

There will be re-balancing opportunities, and if you have cash on the sidelines, I urge you to remain patient. When the signal is separated from the noise, you can bet we will be here to make sure we capitalize as much as we can from the ensuing rebound.

– Adam