Hi all,

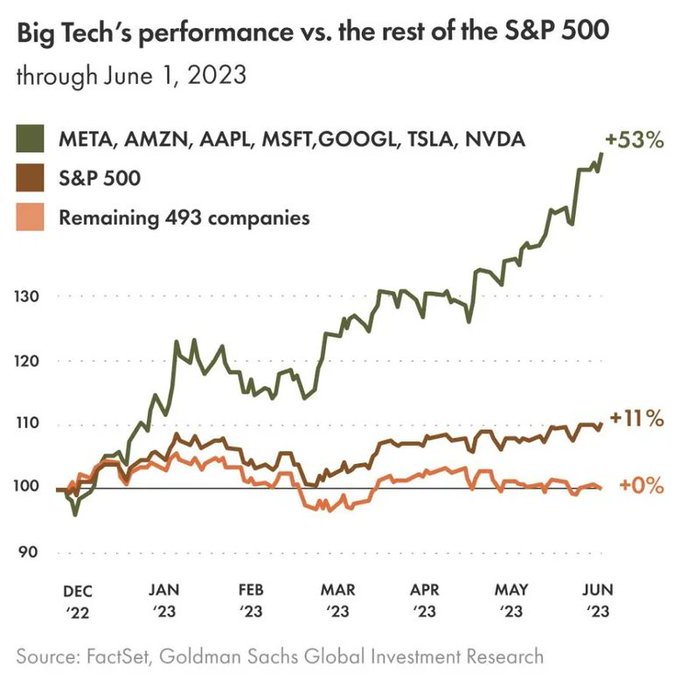

As we wrote last month, we remained cautious on the overall market outlook, mostly due to rising valuations as well as concentration of the largest stocks in the market (now coined the Magnificent Seven, great movie, btw). Well, with Apple down 8%, Netflix down 4%, and Microsoft down 3.5%, we’ve seen very traditional seasonal weakness from the large cap leaders. The current consensus continues to suggest that higher interest rates will continue to work its way through the system and keep a lid on the economy as a whole. While we believe this generally, a strong and resilient economy should be taken as a positive, not a negative.

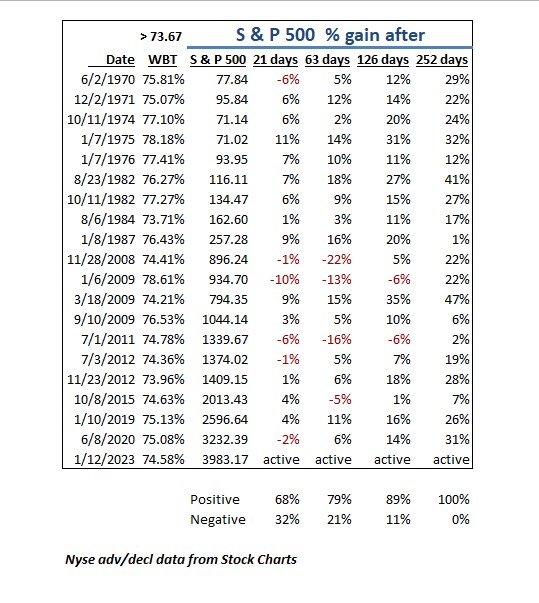

Looking at some historical context, we turn to some research from Callie Cox, investment analyst at eToro, for our first monthly dose of reality.

As you can see from the scatter plot above, when the 10-year yield climbs more than .5% in a month, returns over the next 12 months are mixed, but, on average, still higher.

So, we’ve been expecting a pullback and we got one. Now what? As long term readers of our monthly posts will know, here at Second Level Capital, while we discourage continuous market timing (overtrading), we do feel it is possible for longer-term investors to find better entry points into the market to get their target allocations and certainly see the merit in periodic rebalancing. In order to do this, we focus mostly on the behavioral side of the market. When others are fearful, we become more interested. When others are talking about generational opportunities to speed up the compounding process (*cough* artificial intelligence *cough*), we become more skeptical and try to insert some rationality and see if it passes the smell test.

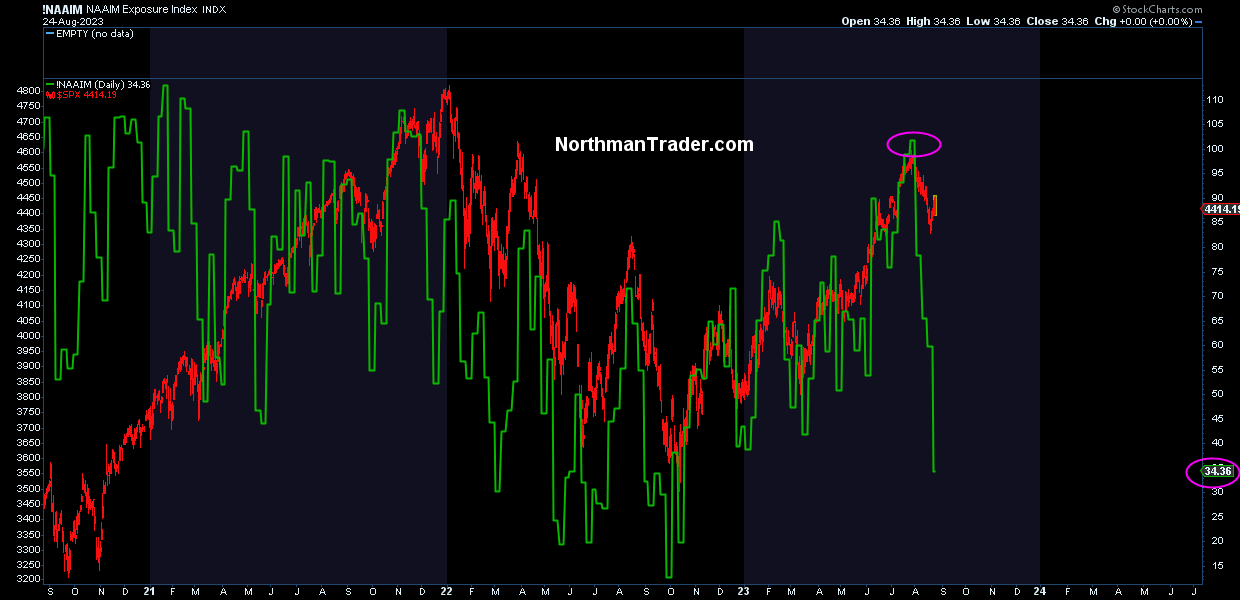

The tough part about this is quantifying how investors FEEL. While the overall S&P fell about 6% from peak to trough over the last month, confidence has fallen off a cliff. As seen below, the weekly survey figures from the North American Asset Managers has gone from 100 earlier this month, to now just above 30. For context, the last time we saw readings this low was last October (just after the market made its low).

As it stands right now, it’s just about as textbook of a pullback as you would want if you believe we are in the early stages of another bull market (as we do). When price doesn’t drop that much, but sentiment falls off a cliff, it sets the stage for the next advance.

We continue to emphasize value sectors over growth (energy and healthcare, specifically) and smaller companies over larger ones (valuation remains reasonable in the smallcaps), we are anticipating a rally into year-end that could feasibly take the S&P 500 to new highs.

In the back of our mind, there is some doubt that remains, so as Cormac McCarthy wrote, “if trouble comes when you least expect it then maybe the thing to do is to always expect it”. We’re keeping our eyes open for anything that may change our tune, but until then, let the market show us the way.

Sincerely,

Adam