Hi all,

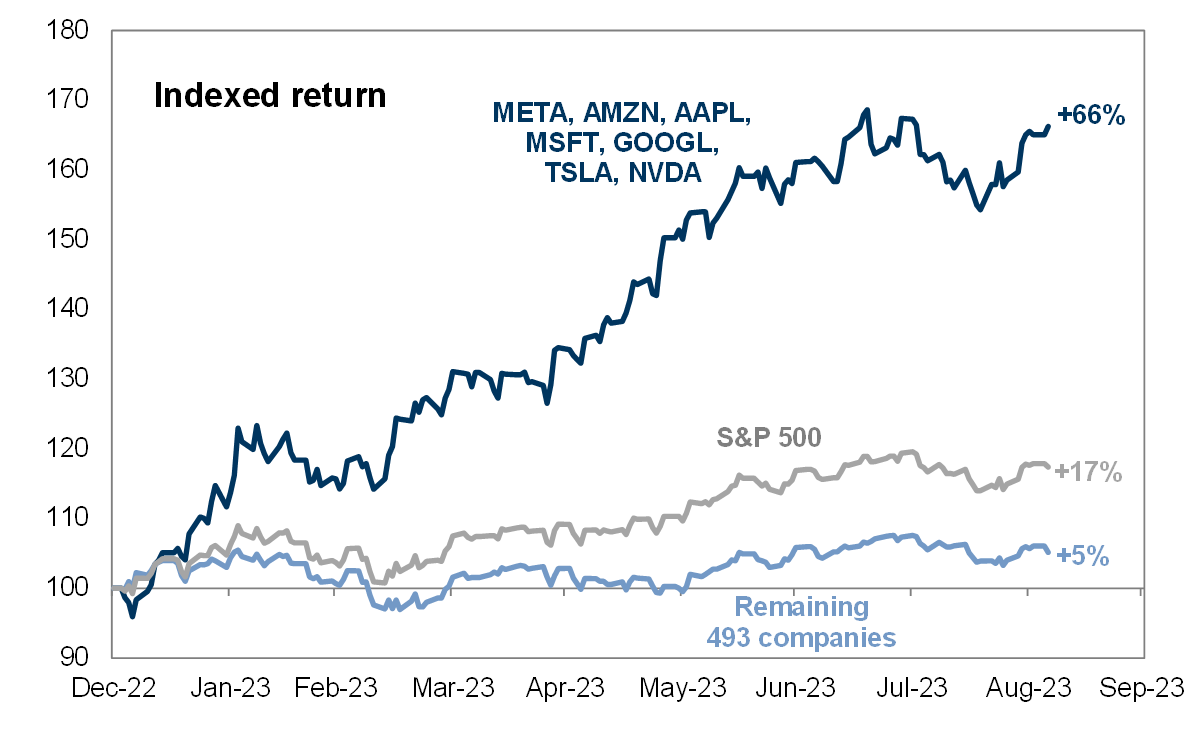

This month’s post is simply an excerpt from a memo that was written in March of 2000. I urge every one of you to read Walter Deemer’s report in its entirety (link is below). Swapping out ‘Cisco’ for a name like ‘NVIDIA’ could provide a little perspective about today’s market and should serve as a great reminder to always stay prepared for what might happen next.

– Adam

Walter Deemer’s Special Report — March 3, 2000

As I said at the outset, what prompted this piece is the arrogance on the part of all too many New Economy (growth) managers who sneeringly tell everyone who is not invested in the same Cisco’s and Qualcomm’s as they are that “this is the way it is and this is the way it’s going to be from now on. The Old Economy stocks are relics of the past and if you don’t own the Cisco’s and Qualcomm’s of the world, no matter what the price, you’re living and investing in the past, not the future.” Again: we are not about to quarrel with the idea that Cisco is a better company than, say, Sears; it is. But investors are not buying Cisco, the company — investors are buying Cisco, the stock, and what seems to be lost on the part of many money managers is the fact that just because Cisco is a better company than Sears does not automatically make Cisco a better stock, too.

To put it even more bluntly: The question that must be asked here is at what price Sears is a better buy than Cisco — and “Never!” is NOT an acceptable answer. The money managers who are in the “My Cisco, right or wrong!” camp and who will not consider alternative investments no matter how low those alternative investments get nor how high Cisco goes — are doomed to eventual disappointment, just as the Nifty Fifty managers, the managers who bought and owned the finest companies in the world at the time, were doomed to eventual disappointment twenty-seven years ago. The question is “when?” — not “whether?”

None of the foregoing is meant to knock growth stock investing per se; clearly, growth investing IS currently working — and working unbelievably well. In addition, given our comments in our regular reports regarding small growth stocks (and the fact that our own money is invested in a small-cap growth-stock fund), we suspect that growth investing will continue to generate superior performance for some unknowable time to come. My quarrel is with the money managers who 1) think that investing in growth stocks, no matter what their price, is the ONLY way to go, now and forevermore, and 2) refuse to consider alternative investments under any circumstances. For all I know, Cisco may be a better stock to own than Sears for a long, long time to come. But there IS a limit somewhere, and investors must thus keep on comparing Sears to Cisco even if the answer keeps coming up “Cisco is still the better stock to own.”

Open-mindedness is one of the signs of a great investor. Arrogance is not.

Full report can be found here