“There are two kinds of forecasters; those who don’t know, and those who don’t know they don’t know” – John Kenneth Galbraith

Hi everybody,

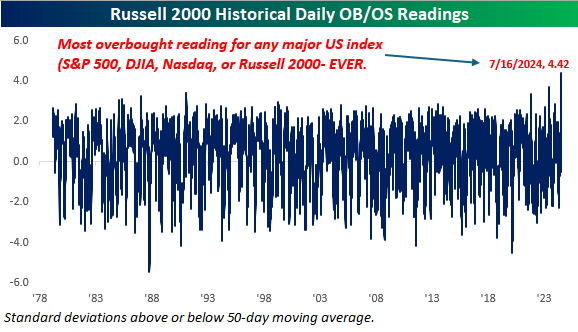

With valuations in large cap tech companies reaching nosebleed levels over the summer, and the fervor over Nvidia and the Magnificent 7, in mid-July something happened that has never happened in the history of the stock market. At the first sight of a tech pullback, the largest and quickest rotation of money moved out of those names into the value-heavy Russell 2000, pushing it more than 4 standard deviations above it’s 50-day moving average (see chart below from Bespoke).

Whenever something happens for the FIRST time in markets, it catches my attention. Combined with stock allocations at an all-time high as a percentage of financial assets, I think we can be comfortable saying that most investors were “all-in”. (see below)

Well, you can guess what happened next. Whenever extreme greed enters the picture, the market has an uncanny ability to humble. From July 17th to August 5th, the Russell 2000 fell 13.2% from peak to trough, punishing late comers to a market rotation that started in October of 2023, but stalled during the first half of 2024.

Those who got smacked on the nose, quickly reversed course during the recent decline, but the market popped back quickly and has already recovered more than 50% of the decline. So the psychology of investors is now a little more skittish than it was when everyone thought they were a genius. As a gentle reminder…

August and September are generally weaker months (the first half of October as well). We are viewing the recent selloff as a precursor to another sell-off in the next few weeks, and during that period of time, we are looking to rebalance away from short-term money markets and large cap technology into more of the “value” type sectors.

If you’re sitting on cash on the sidelines, patience will be paramount, but we DO believe there will be an opportunity in the coming weeks to put that cash to work at better prices. We don’t feel this pullback will derail the bull market, but unfortunately like Walter Deemer says, “when the time comes to buy, you won’t want to.”

Kids are finally back in school. There is a God.

– Adam

Yet another roller coaster ride.