“This is investing, where the smart money isn’t so smart, and the dumb money isn’t really as dumb as it thinks. Dumb money is only dumb when it listens to the smart money.” – Peter Lynch

Media outlets love to sell fear. Imminent recessions. Spiking inflation. The impending doom of commercial real estate. But let me give you a little snapshot of what’s happening in the stock market (which is NOT the economy, please don’t get these two confused).

During the 18 trading days to start the month of November, the S&P 500 was +10.8%. To paraphrase Steve Deppe, chief investment officer at Nerad + Deppe Wealth Management, there have been lots of 18-day stretches where the stock market has gained 10.8% or more (some of them during very difficult times in the stock market and the US economy). But there were no 18-day stretches that closed 10.8% higher AND closed higher 15 out of those 18 days…until last week. One could argue that we are currently in the midst of the strongest, most persistent advance we’ve seen in the past 30 years.

Obviously, a huge factor in the index gain has been the outperformance of the largest companies (the magnificent seven). You might be asking yourself, “Then why don’t we have all our money in the best and biggest companies in the world?”. Because in the last 65 full calendar years (1958-2022), market cap weighting beats equal weighting only 25 of the last 65 years. Almost a full 2/3rds of the time, the average stock beats the big guys. We anticipate 2024 could be a great year for mean reversion, in what I have seen referred to as “Team 493” (for all the other companies in the S&P 500 that no one cares to talk about these days). We continue to recommend building a position in “the others” to capture some gains if/when people start to realize the lofty valuations of the stocks that have run up, and the relative value investing in quality businesses that have been unloved.

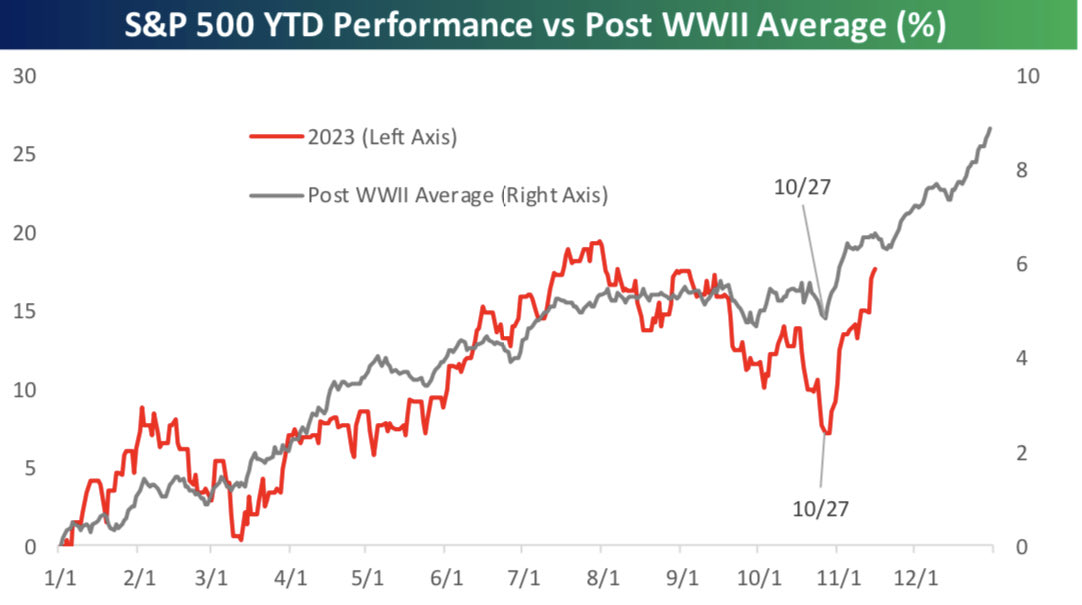

I’ve had several conversations with clients about how this year has been a real roller coaster. Then I casually mention this year has been extremely typical. This is usually followed by a period of silence where they wonder if I’ve been staring at my stock charts too long. Well, see for yourself…doesn’t get any more typical than this when it comes to seasonal pivots and trends.

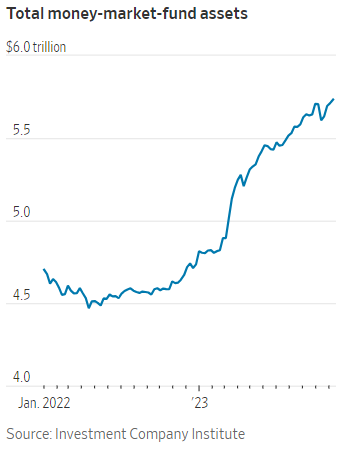

With the Federal Reserve pausing for three straight meetings, the market has sniffed out that as long as inflation continues to moderate toward its 2% target, unemployment remains low, and growth remains strong, it’s quite possible they will CUT interest rates in 2024 as the restrictive policy meant to temper the US economy will no longer be needed. This still remains to be seen, but given the amount of cash that has flown into money markets over the past year, it’s possible the amount of interest you’ll receive over the next 12 months becomes a lot less attractive (reinvestment risk). At that point, savers could be driven back into the stock market to get competitive returns. Even if we end up going back toward January 2022 money market levels, that’s over $1 trillion dollars flowing back toward stocks over the next 12-24 months. Will those dollars buy the “expensive” magnificent seven stocks, or will they go bargain hunting for additional current income to supplement portfolios? We’re betting on the latter.

While the stock market feels like it’s had an incredible advance this year (and it has), the highest price target on the S&P 500 for year-end 2024 is 5100. An S&P 500 over 5000 feels like a pipe dream, but it would only be a 2% annual gain over the previous three years.

This is all to say that we remain bullish in the near-term, as we have since January 12th, 2023 when we got our breakaway momentum signal. Hope everyone had a great Thanksgiving!

– Adam