Hi All,

Frequently, I get feedback from clients about our monthly blog posts, and most of the constructive criticism surrounds me talking less. Point taken. For this month, let’s show a few more visuals.

As you know, the majority of our market timing calls are about buying when people are scared/nervous, and trimming when investors are euphoric (or more precisely, when they start to discard the possibility of future problems).

- This chart comes from the most recent Bank of America Global Fund Manager Survey. As you can see, cash remains the highest overweight, while US stocks have been the vehicle by which they have chosen to raise that cash.

2. For an idea of how much cash in “sitting on the sidelines”, we again turn to Bank of America’s global research department. We now have more cash sitting in money markets than we did at the height of the pandemic.

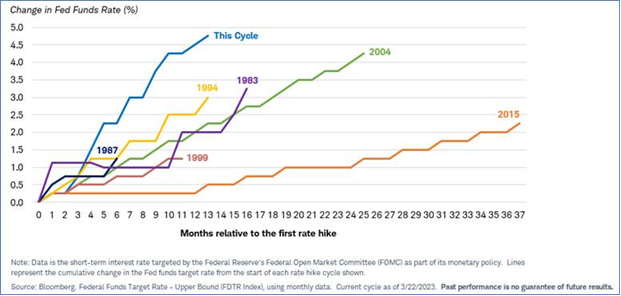

3. Why has all that cash flocked to money markets and US treasuries? Because the federal reserve has raised interests rates at the fastest pace in US history. For years, there was no reasonable alternative to equities, but that time has passed. With investment grade corporate bonds yielding over 5.5% and short term treasuries yielding north of 5%, there are now some very compelling choices.

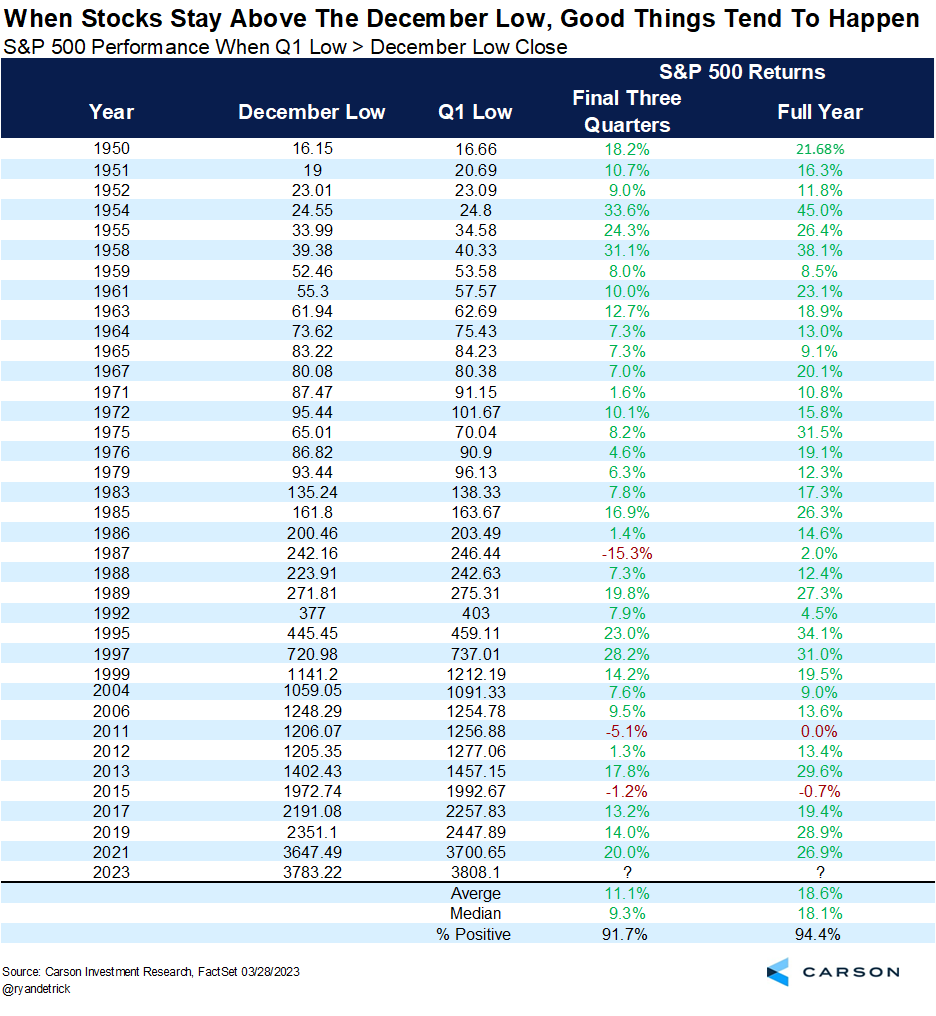

4. The relative calming and grinding upward nature of the stock market, tends to mean sunnier skies are ahead. When the first quarter of year doesn’t go below the lowest price in December, the return for the final three quarters of the year has been higher 33 out of 36 times since 1950 (with an average return of an additional 11%).

5. According to the most recent survey from J.P. Morgan, 95% of respondents believe the S&P has already peaked for 2023.

As a reminder, strongly bearish sentiment DOES NOT mean that stocks will go up from here, but it absolutely tilts the weight of the evidence in favor of stocks going higher. That’s the best we ever get in the stock market. There are a couple market signals that are holding us back from being more aggressive in client accounts, but if/when those signals turn from red to green, we will be ready.

– Adam