Hi All,

We’ve been purposefully waiting a bit to post this month’s missive in the hopes there was something big brewing in the markets. Well, it turns out we’ve seen the first constructive, actionable, bullish signals in the past 24 months.

In January of 2022, we wrote,

“Over the past few years, our position has been some variation of “the trend is your friend”, but in 2022, we feel this is likely to change.”

While we thought 2022 wouldn’t be anything to write home about, the velocity and magnitude of federal reserve interest rate rises certainly caught us off guard in Q1. The idea they would hike interest rates at the fastest pace in history was not something on our radar and our underperformance versus the overall market was a direct result.

But in April, we began to stress the need for patience, foreseeing a bear market rally that would eventually fade, leading to some additional pain.

“The possibility for another sharp advance could be in the cards, but our current view is that more frustration is ahead.”

In August, we rebalanced our more conservative and moderate portfolios, taking advantage of the summer rally by transitioning from municipal and corporate bonds into short-term treasuries, as well as lightening up growth equity exposure, as our tone and actions remained cautious, awaiting additional signals.

In our October blog post entitled, Where’s The Bottom, we wrote,

“Rather than picking a bottom (which is pure luck, even if we were to do it), here’s the conditions that need to occur for a bottom to be cemented.”

I won’t rehash the blog for the entire last year (although I do recommend going back and rereading, if you’re interested), but my point in highlighting some of the past commentary is that we believe the time for more aggressive positioning is upon us.

So what’s changed? Underneath the surface of the market, a lot.

First, we achieved a “breakaway momentum” signal. Below are the forward returns. This is a signal that has only happened 24 times since 1949. 23 out of 24 times, the market has been positive a year later, and on average, 20% higher.

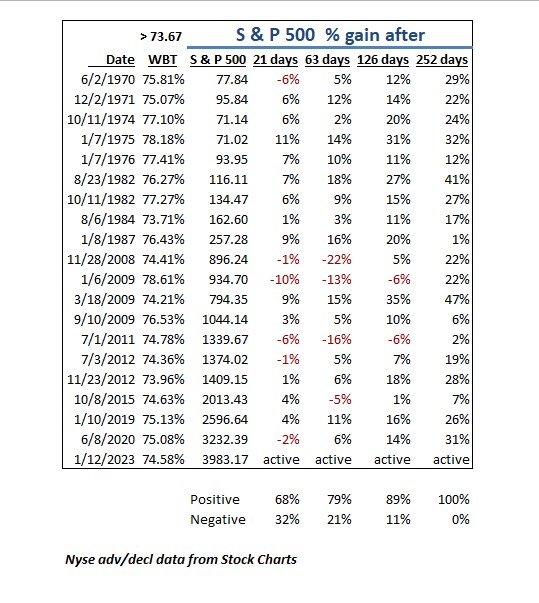

Second, is a different measure of breadth, but just as powerful of a signal. This one is called a Whaley Breadth Thrust. January 12th of this year marked the 20th occurrence since 1970. The previous 19 were all positive one year later, with an average rise of 21.8%.

What does this mean? To me, it means the wind has changed directions. Instead of being in a market environment where we take one step forward and two steps back (bear market), we are now entering a paradigm of two steps forward and one step back (bull market). We believe the odds of allocating capital in this environment have switched decidedly in our favor.

Let me also stress what this doesn’t mean. It does not mean that the S&P 500 will go up every day until we make a new all-time high. It does not mean that there will not be periods of time where the market drops (sometimes substantially) and our confidence will again be shaken. But having the anchor of history on our side does provide the confidence to start allocating more capital to sectors we saw exhibit relatively strength during the last half of 2022 (biotech, small cap) as well as sectors that remain in strong fundamental positions and prioritize returning capital to shareholders in the form of dividends or buybacks (energy, financials).

While risk remains our primary focus, we’re as optimistic about the upcoming year as we have been in more than half a decade. If you’re willing to continue to place your trust in us, and come along for the ride, we believe the next 12 months will be full of surprises (good ones this time).

– Adam

Great write up. Excellent clarity in confusing times.