Hi all,

While we’ve had a nice bounce this month (as was expected), the outlook remains as clear as mud. Here’s a couple things to think about on each side of the ledger.

Valuations

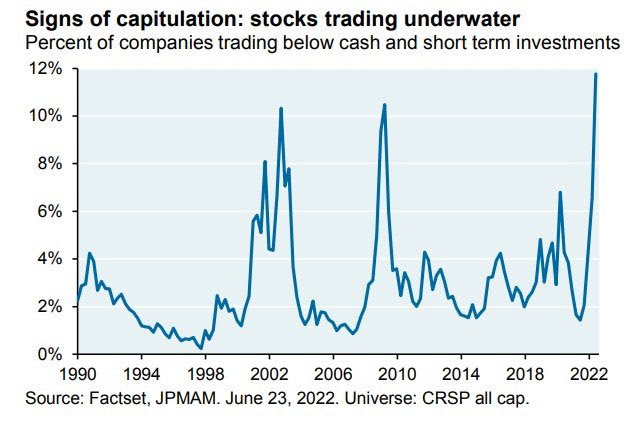

At the June low, there was almost 12% of all companies trading on the NYSE trading at a market value below the amount of cash they had on their balance sheet. This means that the stock market valued their respective businesses at $0. As you can see from the chart above, these types of moves have signaled major bear market bottoms in the past.

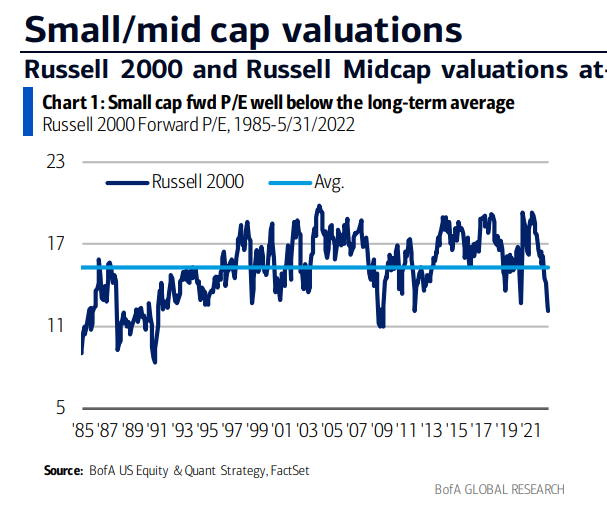

Small and Mid-cap company valuations are now well below the long-term average and currently below where we were in March of 2020, although not yet back to 2008 levels.

Defensive Posturing

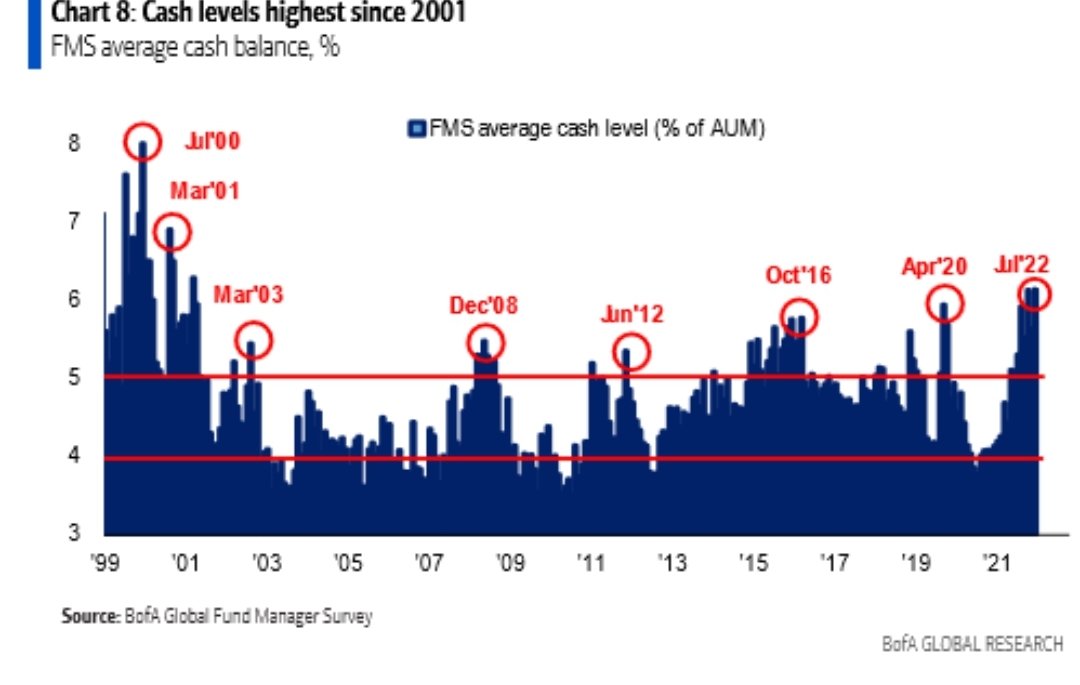

According to the Bank of America Global Fund Manager survey, cash levels are now the highest (as a percentage of assets) since 2001. “Cash on the sidelines” it seems.

Workers

According to ZipRecruiter, there are now 1.8 million more full-time workers than before the pandemic and 2.4 million fewer part-time workers. When the government turns off the taps and interest rates rise, you can almost hear the collective refrain of “I need to get a better job” echoing in everyone’s head.

Historical Trends

According to Jason Goepfert of Bespoke, the S&P 500 has never lost ground over the following 12 months when we’ve had advancing volume of greater than 87% for 2 out of 3 days in the first month coming off a 52-week low. The median returns after this signal is 23% over the next year.

We feel the stock market is inadequately prepared for something to go RIGHT (for once in 2022). This asymmetric risk/reward points to getting more upside out of good news, and less downside out of bad news (since everyone has already positioned themselves for the worst). Because of this, we feel the issue going forward won’t be where we go, but when. Given the Federal Reserve, at present, does not have any intention of providing accommodation to the economy (lowering rates), and a main goal of the administration is to combat inflation (lowering demand), it’s going to be very difficult for the market to gain its footing with its two largest market forces acting against it. The thing to remember here is that the stock market is NOT the economy. The stock market looks forward, while economic data looks backward. It’s one of the main reasons we’ve seen the stock market increase in July. Gasoline prices at the pump have come down over 10%, crude oil pricing is off almost 30% from its highs in March and those declines should start to come through in the inflation data starting this month or next. The stock market is starting to sniff out that things are getting a little better, but will the market rise enough to entice that cash on the sidelines to start nibbling again? We shall see…

Enjoy the last bit of summer and be safe out there.

– Adam