Hi all,

In our previous note, we wrote. “As of now, our outlook is for a pullback into late November and possibly into early-December and then a potential resumption of the rally into year-end. For those with cash on the sidelines, we recommend waiting for a better entry, and we are currently contemplating making additional substantial changes to our models for almost all clients going into next year, but we will reach out individually if/when we decide on what changes need to be made.”

Since the date of the previous post (Nov 19th), we have seen a peak to trough decline in the S&P 500 of 5%, a 7.3% decline in the Nasdaq 100, and a 9.7% decline in the most economically sensitive stocks of the Russell 2000. As of right now our opinion has not changed, but it does have some caveats.

-

- We believe that the omicron variant will continue to show that while it is much more transmissible, it is likely to be less deadly and lead to less hospitalizations than the delta variant (the traditional life cycle of viruses, and very similar to what happened during the Spanish Flu in the early 1900s). We believe this will avoid broad lockdown measures in the United States, which should bolster travel-related stocks, as well as more economically sensitive sectors (energy, cruise lines, casinos, etc).

- The breadth issue we discussed in the previous post has resolved itself. When we see “panic selling” (as defined as greater than 90% volume to the downside on the NYSE) as we did last week, generally we need either back-to-back 80% positive days, or one 90% positive volume day on the NYSE to signal that buyers have started to come back to the market. This condition was acheived Monday and Tuesday of this week, which has lead to the bounce we’ve seen this week.

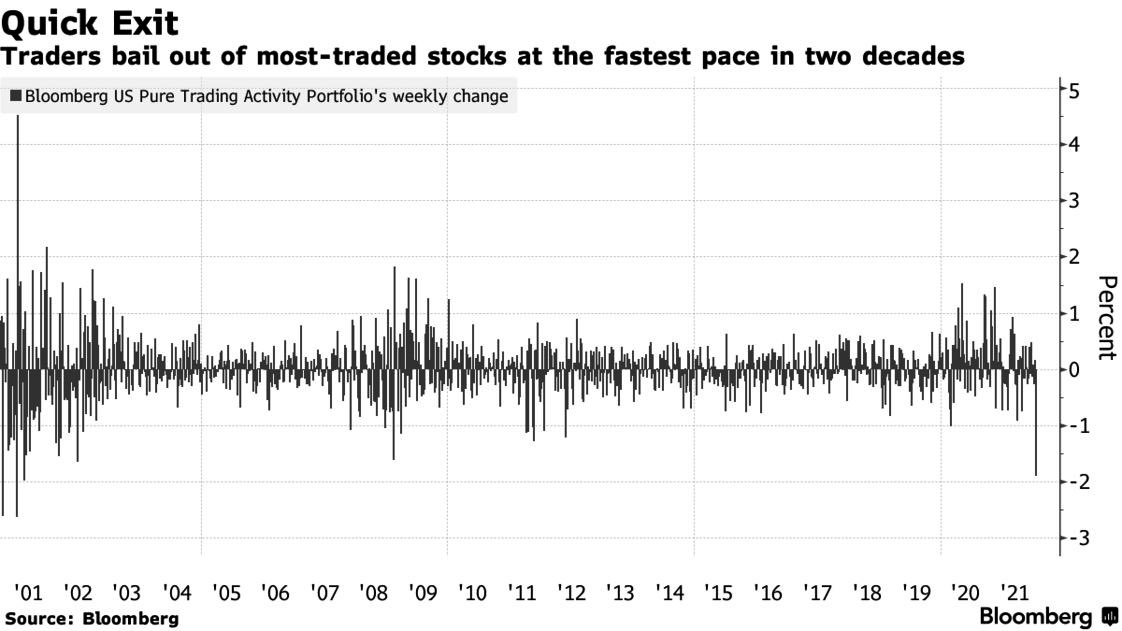

For some more data on sentiment, according to Bloomberg, traders sold out of the most-traded stocks at the fastest pace in the last two decades, even faster than the global financial crisis in 2008-2009.

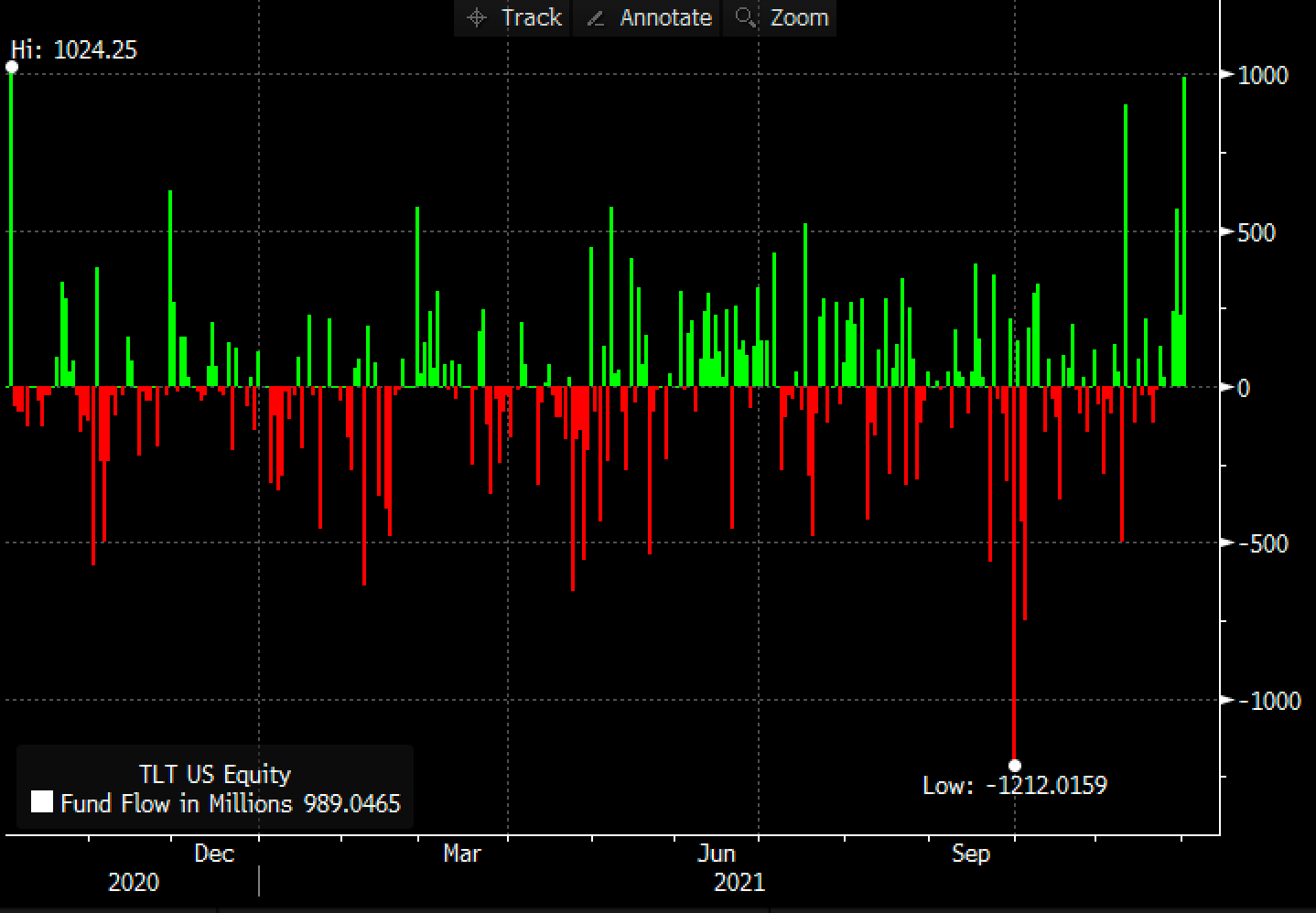

Not surprising, long dated government Treasury bonds had the opposite happen, seeing the largest inflow in almost a year. We believe this flight to safety was warranted, but with the Federal Reserve signaling a possible acceleration of tapering their quantitative easing and potentially interest rates RISING in 2021, I think this flight to safety will be short lived, and investors will head back to the only game in town…stocks.

Our reasons for “buying this dip” are not just technical as well. Per the Bureau of Economic Analysis, profit margins over the last two quarters for U.S. businesses are the highest since 1950.

In addition, historically (according to Factset), December has the highest likelihood of having a positive month, moving up 74.3% of the time since 1950.

We believe we will see a retest of the recent lows, but anticipate that buyers will come in again and setup the traditional Santa Claus rally (the trading days following Christmas before year-end).

Happy Holidays everyone!

– Adam