Hi all,

For our August missive, I thought I’d write a little about some of the things I’m hearing from YOU. I have heard some variation of each of the following points from MULTIPLE clients over the last two months, so if you feel like you’re being singled out here, it couldn’t be further from the truth. And in a counter-intuitive way (perhaps a second-level thinking sort of way?), it’s the reason I believe we continue higher in the equity markets into year-end.

“Stocks are at all-time highs, we should get a pullback pretty soon.”

Yes, the S&P 500 and Nasdaq 100 are currently at all-time highs. While this is true, there’s more to the story. The largest companies in the world have done a tremendous job holding up the indexes, but the pain being felt by investors in other individual names has been strong. A quick search of Bloomberg shows the largest airline ETF has declined 26% from mid-March to mid-August. Emerging markets are down 15% since mid-February, and the epicenter of the individual stock pain has been in the crackdown of Chinese tech companies, with the index seeing greater than a 50% decline in the last six months. An index of recent IPOs is 17% off its highs and SPACs (special purpose acquisition companies), which were all the rage just several months ago, now 38% from its high. Instead of a speculative bubble, it looks to me like the average investor is starting to figure out that fundamentals matter. Last week’s all-time high in the Nasdaq was accompanied by the greatest number of new 52-week lows EVER (281). Some see this as a sign of weakness under the hood and the possibility of a future decline as the strength of the rally narrows (possible). I tend to view it as a market doing it’s job and being discerning.

“Inflation is going to be a problem. Housing prices have gotten out of control.”

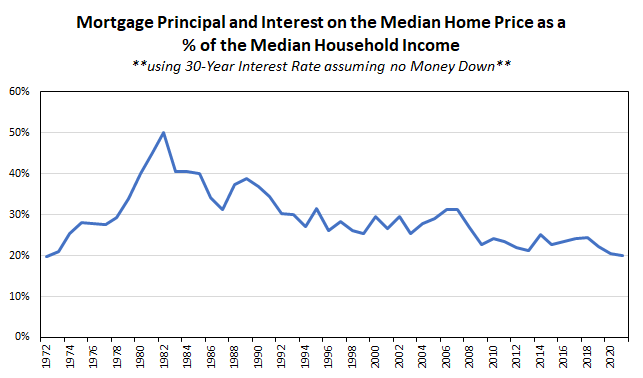

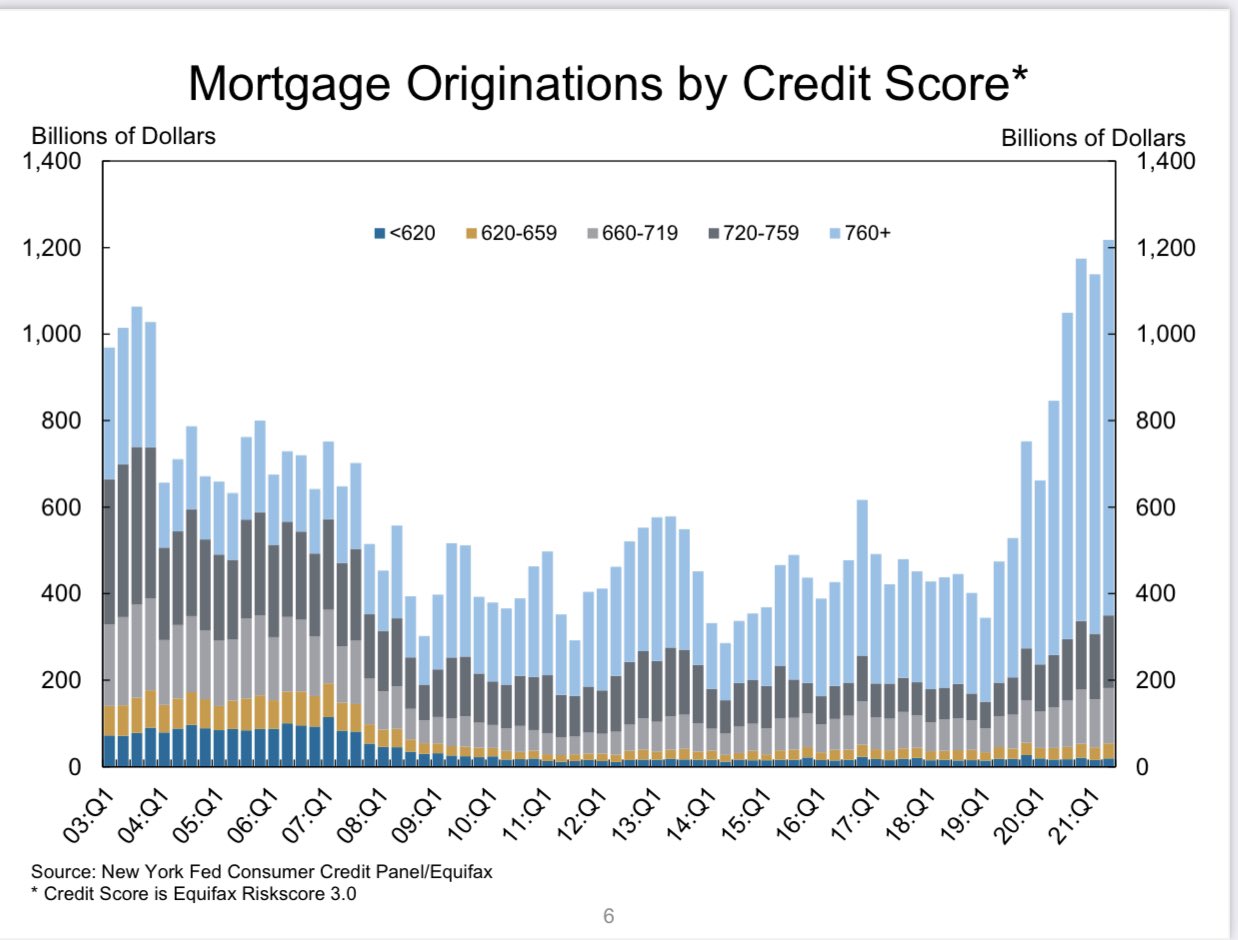

Let me show you a couple charts regarding housing.

At present the principal and interest as a % of income is the lowest in 50 years. In other words, it’s more affordable to own a home, relative to your income than at any other time in the last half century.

And unlike the housing crisis which thrust us into the global financial crisis, this time, it’s the best credit scores looking to own homes.

Every day, week, and month there are issues that pop up, possibly causing the derailing of the current bull market. While it’s our job to keep an eye on developing issues, I’d much rather be a student of price (what’s actually happening) instead of pontificating about future assumptions which may never come to fruition. As of right now, the trend is our friend, but the trend may change, and we stand ready to make overall changes to our model if and when that occurs. But for right now, trying to pick a top in the market is a fool’s errand.

– Adam